The treasury of Ancient Athens, located in the famous Parthenon building, was basically, much like the Federal Reserve building is today, the epicentre of the international monetary system. And the Silver Drachmae was really the dollar of the Mediterranean. Furthermore, the famous port of Piraeus, where sailors from all over the Mediterranean went to trade, but also to visit their bankers. So basically, to stick with the present day analogy, this was the first incarnation of Wall Street.

This post will cover the monetary economics of Ancient Athens. This includes the rise of the silver Drachmae to ancient reserve currency status and how the Athenian financial sector came to be at the centre of what could arguably be the first monetary empire of human civilization.

If you prefer to consume this story in video format, check it out here:

The economy of ancient Athens

Ancient Athens was one of the largest cities of its time. However, the Athenians had one big problem. They did not have enough land to grow the grain needed to feed Athenian bellies. So, they had to import it. And for this, ships were needed. But, buying a single ship was big risk! Sure, if the voyage was successful, the profits would easily be able to cover the initial investment. But the chance of a ship sinking was considerable, and that cost would ruin you for life. So, how should one go about it to finance such a voyage? And even if you make it to the foreign port, what currency should you use to pay for the grain imports? These dilemmas might have been why money and finance went through some of their first major developments in Ancient Athens.

Money in Mesopotamia

Before Athens, big cities in Mesopotamia had monetary systems with a dual core of silver and grain as highest forms of money. However, both had their problems in trade. Grain can better be used to make bread, and silver needs to be weighted and was pretty scarce. Therefore, the monetary systems in these cities evolved such that an outer layer of accounts on clay tablets came to enclose the inner monetary layer of grain and silver. Clay tablets were used to record debts that were denominated in silver and grain. And if you wanted to convert the clay tablet to grain or silver, the state had systems on place that made sure this could be done on request. Since these tablets could easily be identified, created and traded, within Mesopotamian cities, these tablets made excellent money.

The monetary system of Ancient Mesopotamia can be visualised as having a joint silver-grain core and a monetary periphery of clay tablets

The monetary system of Ancient Mesopotamia can be visualised as having a joint silver-grain core and a monetary periphery of clay tablets

Money in ancient Athens

But, for Athens there were two major problems that prevented them from adopting the Mesopotamian monetary system.

The first concerns its monetary core. Since grain had to be imported, it was so scarce that it couldn’t be used as the supreme form of money as it partially was in Mesopotamia. Silver on the other hand, there was plenty since our lucky Athenians had found massive silver deposits just south of the City in the form of the famous Laurian Silver mines. So, yeah, it was basically not a surprise to anyone that they ended up building their monetary system on a silver core rather than a joint grain / silver core.

However, then there was still another problem. Because most grain needed to be imported, Athens relied much more on international trade than Mesopotamian cities. And it just so turns out to be that clay tablets, while being very convenient in local trade were horrible for international trade. The reason for this is that relied on the power of the state for their possible conversion into silver or grain. And since the Athenian state could hardly enforce this conversion in the Turkish cities where most grain came from, clay tablets just wouldn’t work for Athens.

So, the Athenians adapted their monetary core even more. One of the major innovations the Athenians did compared to their ancient forerunners, is that they took that silver from their mines, and minted them into silver coins. This was a major innovation since when pure silver was used, traders had to weight silver to make sure they got payed in full. Wat coinage really is, is a stamp by the state that helps citizens recognise how much silver is in the coins.

In the picture below you see the famous Athenian Owl coin, or the silver Drachmea. This was basically the dollar of the Ancient Mediterranean. Athenian owl coins were found as far as Babylon, Arabia, Southern Italy, Turkey, and Egypt. Some cities even minted these same coins with their own city stamp on it In fact, the Athenian owl came to symbolise money itself. Kind-off like how the dollar sign is often used to refer to money and not to the dollar specifically.

The ancient Athenian Drachmae with Athena on one side and the owl on the other

The ancient Athenian Drachmae with Athena on one side and the owl on the other

The Athenians stored all their silver coins, along with other riches in the famous Parthenon on top of mount Acropolis. Having a lot of silver in a vault is one thing. But, the question that then is remains is how do you get that money to circulate in the economy? One of the biggest problems in monetary economics is about how to get money to circulate. It should get ‘stuck in the system, either because some spoilt rich kid is hoarding it all or some government bureaucrat has a fetish for austerity policies…..

Here also, the Athenians came up with two ingenious innovations to both pump Drachmae into the economy and extract Drachmaes from it. One way coins were pumped into the economy was through state jobs. The unique thing about these state jobs is that they were never permanent. State jobs were jobs like inspecting imported goods in the harbour and being on the jury in court. The jobs were always temporary and citizens circulated through them. The handy dandy thing about this is that it ensured a very equal flow of money into society. Then, for money extraction, the government of Athens was one of the first to establish a tax system.

Now then, you might wonder, what else did the government do to control the supply of silver in the economy? One downside of silver, that people often think is an upside, is that the supply of it is really rigid.

As the economy expands and contracts, it’s actually a great benefit if the money supply can expand and contract along with it. Otherwise prices will be very volatile. And while contracting the silver supply is a bit tricky, the Athenians did have some pretty smart economic incentives in place to increase the quantity of silver when the economy expanded. Namely, they used the awesome power of…. Privatization. Basically, the state did not exploit all mining sites themselves. Instead, they sold mining rights for a specific time and specific patch of land to the highest bidder. As long as there is enough silver underground, there is a bigger incentive to bid for and explore undeveloped mines if the price of silver is getting really high because the economy is expanding too quickly relative to the money supply. Vice versa, if there is inflation and hence silver is losing its value, there at least is no more incentive to mine even more silver.

Finally, the awesome quality of silver coins is that they are both portable and that they do not depend on the credibility of the state. Because all traders at least knew someone …. Who while waiting at home, would love to get some silver jewellery. Therefore, silver coins are extremely useful to facilitate international trade. Take the clay tablets from Mesopotamia as a counter example. In Mesopotamia these clay tablets circulated as money, because the state laws guaranteed that they could be exchanged for grain or silver. However, imagine showing up with one of these in Southern Italy…..

Banking & Finance in ancient Athens

But, the silver coins is not where Athenian monetary innovations stopped. After all, they could not fully replace the clay tablets. While coins were just as easy to trade as clay tablets, they did not replace the other important function of clay tablets, and that was to record debts.

There is a big role for debt based money in the monetary system because it can be created and used where it is needed right away. For example, it can be used to finance great nautical trade adventures in the port of Piraeus. Therefore, it makes sense that it is here that the Wall Street of the ancient world emerged. But rather than sitting in fancy skyscrapers, the bankers of Ancient Athens could be found in the streets with the common traders.

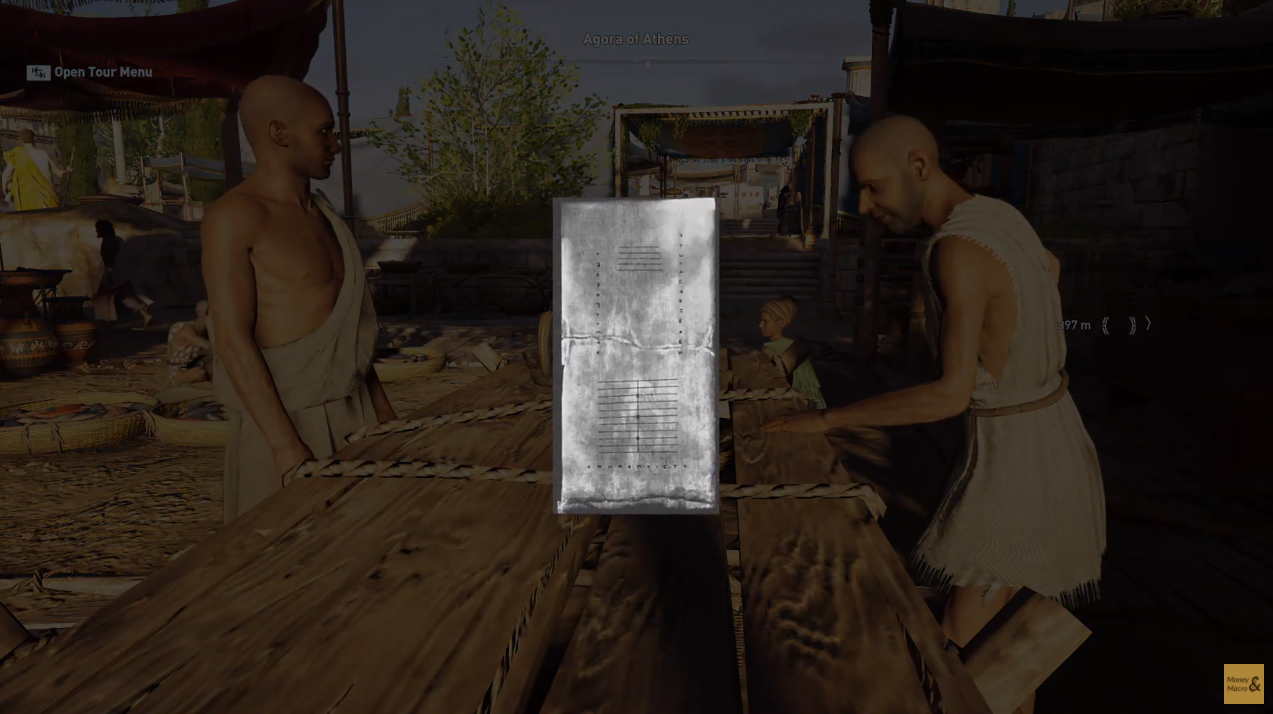

Here their weapon of choice was not the clay tablet. Rather, it was…. a table…. But… okay, fine, it was not just a regular table. In all likelihood they were modelled after the Salamis tablet, which is very similar in function to an Abacus, which while a powerful financial tool in the past, has now been relegated to being a children’s toy! Auch. The Greek special bankers table was known as the Trapeza, and it’s no coincidence that the Greek word for bank is still Trapeza today.

Bankers at a table with a picture of the Salamis table that is similar to how these tables were likely used as a modern day calculator

Bankers at a table with a picture of the Salamis table that is similar to how these tables were likely used as a modern day calculator

There is evidence that bankers accepted deposits, of which some was held in reserve but also a lot was lend out. Some, therefore, consider it the start of modern banking. There is some evidence that the interest rates on loans was roughly 12% for safe loans and 22% to 30% for ship loans, this indicates that the banking system was probably pretty efficient, since loans sharks charge way more than that.

But, it was not only bankers that made ship loans. These were also made by wealthy individuals and groups, although the corporation as we know it had not yet been invented, the Athenians did often bundle their resources to finance complex commercial endeavours.

Ship finance made the existence of Athens possible by financing the ships that imported grain. Think about it, even though you might have the money to finance a voyage, you would not want to take the risk, because if the ship sinks you can forget about any future ventures. Basically, you don’t want to put all your financial eggs in one basket. This is where the Greeks discovered how finance can make commerce possible by spreading risk. After all for a wealthy banker, who is financing 10 ship voyages, the profits of 9 successful ships can more than cover the cost for the one that sank.

That is the reason why Greek shipping loans were structured in such a way that the lender was bearing the risk of a ship sinking. If the ship sank, the loans would be forgiven. But, the cargo would then officially belong to the lender. Sure, it was at the bottom of the sea. But, this is why lenders charge interest rates, to cover these losses. That is… assuming that people acted in good faith.

Well, I can tell you …. Financial fraud is not a modern invention. There was plenty of it in Ancient Greece. Remember, there were no telephones, so how easy would it be to secretly sell your cargo abroad, sink your empty ship, and then ask the lender to look for the cargo at the bottom of the sea. Which …. They could never find….

Financial law in Ancient Athens

Hence, just like in modern day New York and London, the legal system in Ancient Athens developed into a force to be reckoned with. Although this worked a bit differently in Athens, namely if there was a dispute between two parties, they would have to plead to a group of jurors who would decide who was in the right. Let’s say a captain that came back was claiming his ship was stolen while his former banker was claiming the captain was a fraud. Both of them would have to make their case for a large group of jurors, consisting of Athenian citizens. The jurors would then decide who had to pay to up.

Captain and his banker argue in court, trying to convince the jurors

Captain and his banker argue in court, trying to convince the jurors

What’s interesting here is that because Financial contracts were drafted in Athens, even if two parties came from different states, Athenian law would still apply to the contract. This is really similar to how New York judges sometimes are able to do crazy things like order the seizure of ships belonging to a foreign state. To cover debt payments for financial instruments that were issued in New York. If you don’t believe, ask Argentina….

What makes Athenian money and finance so interesting?

Well, for me, there are a couple of reasons. They popularized coinage, making it so that traders no longer had to weigh their silver. Also, they had a really innovative way of introducing into and taking currency out of the economy, via rotating jobs and taxes respectively.

Furthermore, they partly left money creation by leasing out silver mines. They pioneered international private banking, and were one of the first cities to have their courts influence global trade, even if it didn’t involve any Athenians.

Basically, you could say that Ancient Athens had the first international monetary empire.

Summary

Here’s a quick recap of that Athenian monetary system. It was built on silver coins which were minted by the state. Silver was mined by private miners that bought mining rights from the state. There was then a large layer of bank created money and financial instruments that rested on top of the silver coin core, much like how it is today.

Overview of the monetary system of Ancient Athens, built on a silver coin core and with a large outer layer of bank / financial money

Overview of the monetary system of Ancient Athens, built on a silver coin core and with a large outer layer of bank / financial money

Making the monetary system of Ancient Athens, a really nice template for all future monetary systems which I will be exploring in future posts and videos.

My main source for this blog was Ch4 from the Amazing book Money Changes Everything, specifically chapters 5 and 6

If you found this post interesting consider leaving a comment and subscribing to our YouTube channel using the button below